Succession of Estate

Whenever a person dies leaving his/her property behind, the question arses as to how his/her property will be dealt with. The Distribution of assets of the deceased individual in India is governed by Laws of Succession. Indian Succession Act, 1925 (“Act”) mainly outlines such distribution of assets after the death of the person which is divided into testamentary succession and Intestate succession which are briefed as under:

Testamentary Succession

- This type of succession takes place when a deceased person leaves behind his/her Will, directing the distribution of his property after his death.

- The property distribution is done as per the wish of the deceased in accordance with the will or any other testamentary document.

- It is governed by The Indian Succession

Intestate Succession

- This type of succession takes place when a person dies without leaving behind his/her will i.e, he dies without a Will.

- In this case, the distribution of the property is done as per the inheritance law applicable to the deceased person.

- It is governed by the law of inheritance applicable to the deceased person (based on religion). Eg. The Hindu Succession Act, 1956 prescribes the rules relating to succession applicable to Hindus, Sikhs, Buddhists, Jains etc. Christians are governed by Indian succession act, 1925 for succession purpose. As such, Muslims are governed by Mohammedan Law of Succession

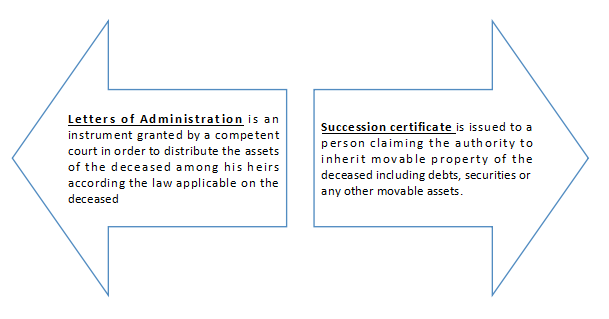

It is pertinent to note that in case there is a will, the property of the deceased person is distributed in accordance with such will and in absence of such will or any other testamentary document, the estate is distributed in accordance with the law applicable to the deceased basis his/her religion. In such absence, the property of the deceased is claimed through the Letter of Administration or Succession Certificate issued by the Court.

Among Hindus

In case Hindu male dies, following persons can claim his property:

- First Claim: Class I legal heirs

Son/Daughter, Widow, Mother; Son/daughter of a pre-deceased son/daughter; Widow of a pre-deceased son, Son of pre-deceased son of pre-deceased son, Daughter of pre-deceased son of pre-deceased son; Widow of a pre-deceased son of pre-deceased son; - Second Claim: In the absence of Class I heirs, the Class II heirs

Father, Son’s daughter’s son, Son’s of daughter’s daughter, Brother, Sister, Daughter’s son’s son, Daughter’s son’s daughter, Daughter’s daughter’s son, Daughter’s daughter’s daughter, Brother’s son, Sister’s son, Brother’s daughter, Sister’s daughter, Father’s father, Father’s mother;

when there are more than one heir in any of above class, then they shall inherit equally.

- Third Claim : In the absence of heirs of Class I and Class II, Class III heirs :Agnates ;

- Fourth Claim: In absence of heirs of Class I and Class II, Agnates:

Cognates

A person said to be a ‘Agnate’ of the other if the two of them are related by blood or adoption wholly through the males. Similarly, a person is said to be the Cognate of the other if the two of them are related by blood or adoption, but not totally through males i.e. there has to be some intervention by a female ancestor somewhere.

In case Hindu female dies, following persons can claim his property:

- First Claim: Class 1 relatives are somewhat similar ie Husband, sons and daughters, including children of predeceased son/daughter;

- Second Claim: heirs of the husband;

- Third Claim: mother and father of the deceased, if alive;

- Fourth Claim: heirs of father;

- Fifth Claim: heir of mother

Any property inherited by a female Hindu from her mother or father shall devolve in absence of any son or daughter of the deceased (including the children of any pre-deceased son or daughter) not upon their heirs as referred above but upon the heirs of the such father or mother.

Any property inherited by a female Hindu from her husband or father in law shall devolve in absence of any son or daughter of the deceased (including the children of any pre-deceased son or daughter) not upon their heirs as referred above but upon the heirs of the husband.

The brief of intestate succession according to the religion is outlined below:

In case Hindu dies intestate without any heir as mentioned above, then the property shall devolve to the Government of India subject to law.

Among Muslims

Among Christians, Parsis, Jews

- Different personal laws are there for Shias and Sunnis. For Sunnis following Hanafi Law (most Muslims in India follow this law) that restricts legacies to maximum one-third of the estate remaining after taking care of funeral expenses, outstanding wages of domestic servants and debts etc.

- The remaining estate is required to be distributed amongst legal heirs. There are three classes of legal heirs:

Sharers- these legal heirs are entitled to a prescribed share of the estate

Residuaries – they will get remaining estate, if anything remains are sharers get their prescribed shares.

Distant kindered – they are other relatives who are neither sharers nor residuaries. They will only get if there are no Sharer or residuary.

Meher i.e. Dower promised by husband, would be 1st charge (priority debt), if the same has not been paid by deceased during his lifetime.

- The Christian law of succession is governed by the provisions in the Indian Succession Act, 1925. The smaller communities like Christians, Parsis, Jews etc. are covered by this act which is applicable on intestate as well as testamentary succession.

- A Christian’s legal heirs are the widow/widower inherits one-third share and balance goes to the lineal descendants.

- In case there are no lineal descendants, then one-half goes to the widow and balance to the other relatives, i.e. prescribed as kindered

Amongst the lineal descendants, each child or if pre-deceased, his children collectively will get equal shares. In the kindered, the first preference is given to the father and in case he is predeceased then mother, brother and sister (or their children together if any one is predeceased) equally.

Transmission of Shares

On death, a deceased person might also have some shares held in his/her name which needs to be transmitted to his/her successor(s)/legal heir(s)/nominee. Process of passing the ownership/title of shares to the legal successor(s)/legal heir(s) is called as transmission of shares.

The process of transmission of shares in India is governed by the Companies Act, 2013 and SEBI Regulations are also applicable is case the shares of listed company is required to be transmitted.

Section 56 of the Companies Act, 2013 governs the transmission of shares. It gives the Company a power to register, on receipt of an intimation of transmission of any right to securities by operation of law from any person to whom such right has been transmitted.

Documents required for transmission of shares are specified in Schedule II of the Companies Act, 2013:

| Securities held in physical mode or DEMAT mode | ||

| Shares are held singly or jointly | ||

| With nomination | Without nomination: Following documents along with documents as specified in case of "With nomination" are required | |

1. Duly signed transmission request form by the claimant; 2. Copy of death certificate of security holder attested | Affidavit from all the legal heirs made on appropriate non-judicial stamp paper- to the effect of identification and claim of legal ownership to the securities. *Provided that in case the legal heir(s) or claimant(s) is named in the succession certificate or probate of will or Letter of Administration, an Affidavit from such legal heir(s) or claimant(s) alone would be sufficient. | |

by claimant; 3. Self-attested copy of PAN card; 4. For securities held in physical mode: The original share certificate is to be sent to the company and scanned copy to be attached with the form For securities held in DEMAT mode: Copy of transaction statement duly certified by Depository Participant; 5. Any other government ID proof of the nominee | For value of securities up to Rs. 5,00,000 (Rupees Five lakh only) per issuer company as on date of application, one or more of the following documents: (i) Succession certificate or probate of will or will or letter of administration or Decree, as may be applicable in terms of Indian Succession Act, 1925. (39 of 1925) or any other Decree or Order of any Court or Tribunal, or; (i) No objection certificate from all legal heir(s) executed by all the legal heirs of the deceased holder not objecting to such transmission (or) copy of Family Settlement Deed duly notarized and (ii) An Indemnity bond made on appropriate non-judicial stamp paper – indemnifying the STA or Issuer Company. | For value of securities more than Rs. 5,00,000 (Rupees Five lakh only) per issuer company as on date of application: Succession certificate or probate of will or will or letter of administration or Decree, as may be applicable in terms of Indian Succession Act, 1925. (39 of 1925) or any other Decree or Order of any Court or Tribunal |

* The limit of Rs. 5,00,000 may vary from company to company. The Company may enhance the limit of Rs. 5,00,000 (Rupees Five lakh only) per issuer company in accordance with SCHEDULE VII of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, after taking approval of its Board of Directors and provide copy of Board resolution to Authority at the time of verification of claim; As per LODR, such threshold limit can be enhanced in case of securities held in physical mode. In case of will, following documents shall also be required: (a) Legal heirship certificate issued by Competent Authority; (b) No Objection Certificate from all legal heirs in favor of the claimant; (c) Affidavit from witness about confirmation of will wherever alive or death certificate of such witness; (d) Affidavit with regard to the will as last will and no matter is pending before any court with regard to such will; (e) Surety affidavit by at least two sureties with their PAN Card | ||

Further, in case of listed company, Schedule VII of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 provides for the procedure followed/documents required to be submitted to the Authority to register transfer/transmission of securities

Requirement of PAN

PAN (identity proof in case of Sikkim) of both transferor and transferee is required for registering transfer. Sufficient documentary evidence in support of transferor ad transferee shall be sought by the company, in case of mismatch of PAN card details as well as difference in maiden name and current name.

Mismatch in signature

(i) For minor mismatch: Company shall promptly send to the first transferor(s), via speed post an intimation of the defect in the documents and inform the transferor(s) that objection, supported by valid proof, is not lodged by the transferor(s) with the listed entity within fifteen days of receipt of the listed entity’s letter, then the securities shall be transferred;

(ii) For major mismatch/non availability of signature: Company shall promptly send an objection memo along with documents in original stating the reason as “material signature/non availability of signature”. Following documents shall be required from the transferor in this case:

- An Affidavit to update transferor(s) signature in its records;

- An original unsigned cancelled cheque and banker’s attestation of the transferor(s) signature and address; Same shall be in from ISR-2 as per SEBI circular dated November 03, 2021;

- Contact details of the transferor

Documents required in case of transmission of securities

| Securities held in physical mode or DEMAT mode | ||

| Shares are held singly or jointly | ||

| With nomination | Without nomination: Following documents along with documents as specified in case of "With nomination" are required | |

1. Duly signed transmission request form by the legal heir(s) claimant; 2. Original death certificate or copy of death certificate of security holder attested by claimant subject to verification with original/copy of death certificate duly attested by notary public or by a Gazetted officer; 3. Self-attested copy of PAN card; | 1. Affidavit from all the legal heirs made on appropriate non-judicial stamp paper- to the effect of identification and claim of legal ownership to the securities. *Provided that in case the legal heir(s) or claimant(s) is named in the succession certificate or probate of will or Letter of Administration or Legal Heir Certificate or equivalent certificate issued by the competent government authority, an Affidavit from such legal heir(s) or claimant(s) alone would be sufficient; 2. Copy of succession certificate or probate of will or will or letter of administration or Decree, as may be applicable in terms of Indian Succession Act, 1925. (39 of 1925) or legal heir certificate or its equivalent certificate issued by competent Government Authority, attested by the legal heir(s)/claimant(s) subject to verification with the original or duly attested by a notary public or by a Gazetted Officer. where a copy of Will or a Legal Heirship Certificate or its equivalent certificate issued by a competent Government Authority is submitted: Indemnity bond from the legal heir(s) /claimant(s) to whom the securities are transmitted, in the format specified by the Board must also be submitted. where a copy of Legal Heirship Certificate or its equivalent certificate issued by a competent Government Authority is submitted: No Objection from all non-claimants, stating that they have relinquished their rights to the claim for transmission of securities, shall also be submitted. | |

For value of securities up to Rs. 5,00,000 (Rupees Five lakh only) per listed company, in case of securities held in physical mode, and upto Rupees 15 Lakhs per beneficial owner, in case securities are held in dematerialized form and where document sought in point no. 2 above is not available, then following documents must be submitted: (i) No objection certificate from all legal heir(s) executed by all the legal heirs of the deceased holder not objecting to such transmission (or) copy of Family Settlement Deed executed by all the legal heirs duly attested by notary public or by a gazetted officer And (ii) Notarized Indemnity bond made on appropriate non-judicial stamp paper – indemnifying the STA or Issuer Company in specified format. Provided that the listed entity may, at its discretion, enhance the value of securities from the threshold limit of rupees five lakhs, in case of securities held in physical mode. | ||

Further, SEBI Circular dated November 03, 2021 is to be read with above provisions.

To avail the assistance in the aforesaid procedure, please contact us.