Quick guide on IEPF Claims

Provisions under governing Laws:

- The Companies Act, 2013: Section 124(6) and Section 125 read with Rule 7 of Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016 and Schedule II and III made thereunder;

- The SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015;

- The Indian Succession Act, 1925

The Companies Act, 2013

According to the section 125(2) Companies Act, 2013 (“Act”), following sums are credited to the fund:

- the amount given by the Central Government by way of grants after due appropriation made by Parliament by law in this behalf for being utilized for the purposes of the Fund;

- donations given to the Fund by the Central Government, State Governments, companies or any other institution for the purposes of the Fund;

- the amount in the Unpaid Dividend Account of companies transferred to the Fund under sub-section (5) of section 124;

- the amount in the general revenue account of the Central Government which had been transferred to that account under sub-section (5) of section 205Aof the Companies Act, 1956 (1 of 1956), as it stood immediately before the commencement of the Companies (Amendment) Act, 1999 (21 of 1999), and remaining unpaid or unclaimed on the commencement of this Act;

- the amount lying in the Investor Education and Protection Fund under section 205Cof the Companies Act, 1956;

- the interest or other income received out of investments made from the Fund;

- the amount received under sub-section (4) of section 38;

- the application money received by companies for allotment of any securities and due for refund;

- matured deposits with companies other than banking companies;

- matured debentures with companies;

- interest accrued on the amounts referred to in clauses (h) to (j);

- sale proceeds of fractional shares arising out of issuance of bonus shares, merger and amalgamation for seven or more years;

- redemption amount of preference shares remaining unpaid or unclaimed for seven or more years; and

- all amounts payable as mentioned in clause (a) to (n) of sub-section (2) of section 125 of the Act;

- all shares in accordance with sub-section (6) of section 124 of the Act;

- all the resultant benefits arising out of shares held by the Authority under clause (b);

- all grants, fees and charges received by the Authority under these rules;

- all sums received by the Authority from such other sources as may be decided upon by the Central Government;

- all income earned by the Authority in any year;

- all amounts payable as mentioned in sub-section (3) of section 10B of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970, section 10B of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980 and section 40A of the State Bank of India (Subsidiary Bank) Act, 1959; and’.]

- all other sums of money collected by the Authority as envisaged in the Act.

As per section 125(4) of the Act, any person claiming to be entitled to the above amount/shares credited to IEPF may make an application to IEPF Authority.

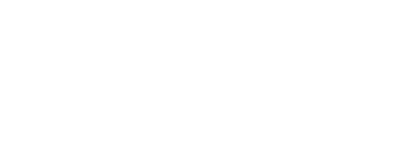

Rule 7 of Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016 outlines the process of making an application to IEPF Authority:

Claimant shall have to submit an online application in IEPF-5 on website www.iepf.gov.in

Online transmission of IEPF-5 to Nodal Officer of the Company

Claimant shall make physical submission following documents to the Nodal officer of the Company at registered office of the company:

- IEPF-5;

- Original share certificate/Bond/Deposit certificate/Debenture Certificate;

- Indemnity Bond;

- Other documents

*All these documents must be self-attested

Company shall verify the claim of the Company and shall, in 30 days of receipt of the claim, send online verification report, along with all the documents submitted by the claimant, to the Authority.

*If the company fails to submit the verification report in 30 days, then same may be submitted after paying an additional fees. In any case, such report must be submitted by the Company in maximum 60 days from the date of filing of IEPF-5. In case of failure to submit the report, company shall be punishable under the Act.

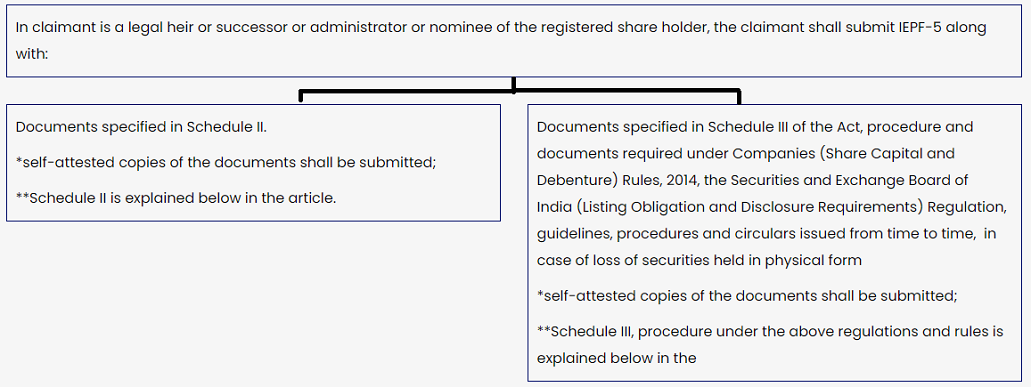

Schedule II: Documents to be submitted to the Authority to register transmission of securities

| Securities held in physical mode or DEMAT mode | ||

| Shares are held singly or jointly | ||

| With nomination | Without nomination: Following documents along with documents as specified in case of "With nomination" are required | |

1. Duly signed transmission request form by the claimant; 2. Copy of death certificate of security holder attested by claimant; 3. Self-attested copy of PAN card; 4. For securities held in physical mode: The original share certificate is to be sent to the company and scanned copy to be attached with the form For securities held in DEMAT mode: Copy of transaction statement duly certified by Depository Participant; 5. Any other government ID proof of the nominee | Affidavit from all the legal heirs made on appropriate non-judicial stamp paper- to the effect of identification and claim of legal ownership to the securities. *Provided that in case the legal heir(s) or claimant(s) is named in the succession certificate or probate of will or Letter of Administration, an Affidavit from such legal heir(s) or claimant(s) alone would be sufficient. | |

For value of securities up to Rs. 5,00,000 (Rupees Five lakh only) per issuer company as on date of application, one or more of the following documents: (i) Succession certificate or probate of will or will or letter of administration or Decree, as may be applicable in terms of Indian Succession Act, 1925. (39 of 1925) or any other Decree or Order of any Court or Tribunal, or; (i) No objection certificate from all legal heir(s) executed by all the legal heirs of the deceased holder not objecting to such transmission (or) copy of Family Settlement Deed duly notarized and (ii) An Indemnity bond made on appropriate non-judicial stamp paper – indemnifying the STA or Issuer Company. | For value of securities more than Rs. 5,00,000 (Rupees Five lakh only) per issuer company as on date of application: Succession certificate or probate of will or will or letter of administration or Decree, as may be applicable in terms of Indian Succession Act, 1925. (39 of 1925) or any other Decree or Order of any Court or Tribunal | |

* The limit of Rs. 5,00,000 may vary from company to company. The Company may enhance the limit of Rs. 5,00,000 (Rupees Five lakh only) per issuer company in accordance with SCHEDULE VII of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, after taking approval of its Board of Directors and provide copy of Board resolution to Authority at the time of verification of claim; As per LODR, such threshold limit can be enhanced in case of securities held in physical mode. In case of will, following documents shall also be required: (a) Legal heirship certificate issued by Competent Authority; (b) No Objection Certificate from all legal heirs in favor of the claimant; (c) Affidavit from witness about confirmation of will wherever alive or death certificate of such witness; (d) Affidavit with regard to the will as last will and no matter is pending before any court with regard to such will; (e) Surety affidavit by at least two sureties with their PAN Card | ||

Schedule III: Documents to be submitted to the Authority in case of loss of securities held in physical mode

| SI.No. | Documents |

| 1 | Self-attested copy of FIR/ Police Compliant containing information of security holder, holding details, folio number and distinctive numbers of share certificate |

| 2 | Surety Affidavit of along with his Proof of identity like Pan Card of sureties duly attested by Notary. |

| 3 | Indemnity bond by security holder on a non-judicial stamp paper of requisite value duly attested by Notary Public by the person, in whose name the original share certificate are being issued that he has not sold / disposed off the involved shares or acted in any manner by which any interest of third party would have been created. |

| 4 | Copy of advertisement issued in at least one English language national daily newspaper having nationwide circulation and in one regional language daily newspaper published in the place of registered office of company, if the market value of the shares is greater than Rs. 5,00,000. |

The SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015

Schedule VII of SEBI LODR provides for the procedure followed/documents required to be submitted to the Authority to register transfer/transmission of securities:

A. Requirement of PAN

PAN (identity proof in case of Sikkim) of both transferor and transferee is required for registering transfer. Sufficient documentary evidence in support of transferor ad transferee shall be sought by the company, in case of mismatch of PAN card details as well as difference in maiden name and current name.

B. Mismatch in signature

(i) For minor mismatch: Company shall promptly send to the first transferor(s), via speed post an intimation of the defect in the documents and inform the transferor(s) that objection, supported by valid proof, is not lodged by the transferor(s) with the listed entity within fifteen days of receipt of the listed entity’s letter, then the securities shall be transferred;

(ii) For major mismatch/non availability of signature: Company shall promptly send an objection memo along with documents in original stating the reason as “material signature/non availability of signature”. Following documents shall be required from the transferor in this case:

- An Affidavit to update transferor(s) signature in its records;

- An original unsigned cancelled cheque and banker’s attestation of the transferor(s) signature and address; Same shall be in from ISR-2 as per SEBI circular dated November 03, 2021;

- Contact details of the transferor

C. Documents required in case of transmission of securities

| Securities held in physical mode or DEMAT mode | ||

| Shares are held singly or jointly | ||

| With nomination | Without nomination: Following documents along with documents as specified in case of "With nomination" are required | |

1. Duly signed transmission request form by the legal heir(s) claimant; 2. Original death certificate or copy of death certificate of security holder attested by claimant subject to verification with original/copy of death certificate duly attested by notary public or by a Gazetted officer ; 3. Self-attested copy of PAN card; | 1. Affidavit from all the legal heirs made on appropriate non-judicial stamp paper- to the effect of identification and claim of legal ownership to the securities. *Provided that in case the legal heir(s) or claimant(s) is named in the succession certificate or probate of will or Letter of Administration or Legal Heir Certificate or equivalent certificate issued by the competent government authority, an Affidavit from such legal heir(s) or claimant(s) alone would be sufficient; 2. Copy of succession certificate or probate of will or will or letter of administration or Decree, as may be applicable in terms of Indian Succession Act, 1925. (39 of 1925) or legal heir certificate or its equivalent certificate issued by competent Government Authority, attested by the legal heir(s)/claimant(s) subject to verification with the original or duly attested by a notary public or by a Gazetted Officer. where a copy of Will or a Legal Heirship Certificate or its equivalent certificate issued by a competent Government Authority is submitted: Indemnity bond from the legal heir(s) /claimant(s) to whom the securities are transmitted, in the format specified by the Board must also be submitted. where a copy of Legal Heirship Certificate or its equivalent certificate issued by a competent Government Authority is submitted: No Objection from all non-claimants, stating that they have relinquished their rights to the claim for transmission of securities, shall also be submitted. | |

public or by a gazetted officer And (ii) Notarized Indemnity bond made on appropriate non-judicial stamp paper – indemnifying the STA or Issuer Company in specified format. Provided that the listed entity may, at its discretion, enhance the value of securities from the threshold limit of rupees five lakhs, in case of securities held in physical mode. | ||

SEBI Circular dated November 03, 2021 is to be read with above provisions